In 1982 he opened his first art gallery in Windsor and in 1987 he moved the gallery to Yorkville in Toronto Ontario. The gallery remained open until 1992 at which time the premises were sold. He returned the gallery to Windsor and operated as a private dealer. In 2005, he opened Lakeshore Fine Art in Tecumseh Ontario until once again the premises were sold. Allen Wahby has sold works by such renowned Masters as Marc Chagall, Pablo Picasso and Andy Warhol. Additionally, he sold a major work by noted Quebec artist Marc- Aurele Fortin which eventually sold at auction for a world record price for that artist.

He retired from medicine in 2020 with the intention of devoting full time to his gallery. Unfortunately, this was curtailed by Covid. He is pleased to say that his new art gallery will be opened in June 2023. He is excited to invite his former clients as well as all those interested in acquiring fine paintings from various Canadian, American and International artists, to his new venue in Windsor Ontario.

Media Coverage

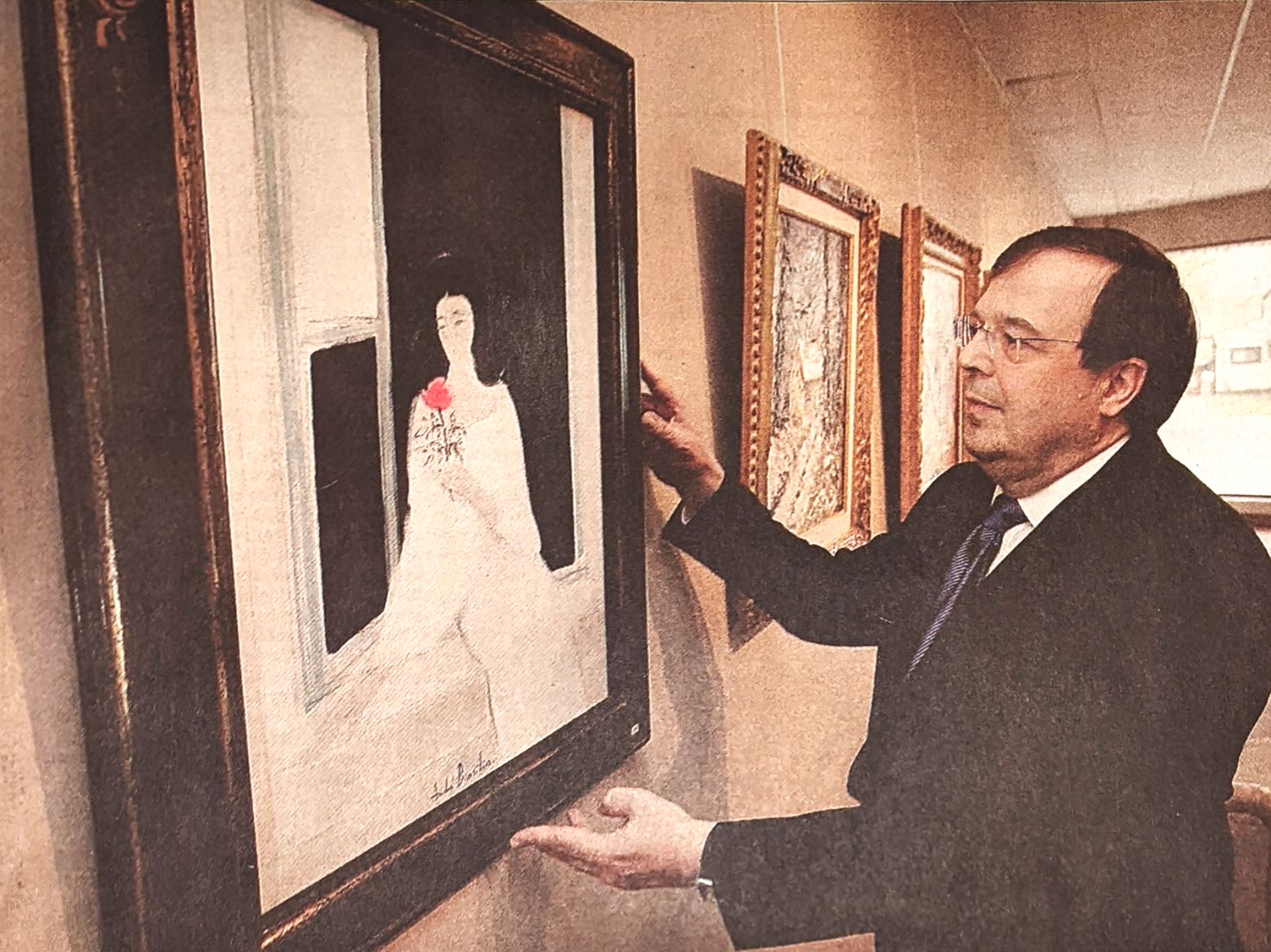

Hung up on art

The Windsor Star | Saturday, May 24th, 2008 | Craig Pearson - Star Staff Reporter | Tecumseh

Investing in contemporary works brings unending pleasure

While undergoing medical training in Montreal in the ‘70s, Dr. Allen Wahby developed his profession - and his passion.

Going gallery to gallery with buddies, Wahby couldn’t yet afford to buy original art, but he certainly learned to love it.

“When I was training in Montreal, we used to haunt the galleries,” Wahby said. “We had no money so we’d just go to galleries and look around.

“When I got into practice I started buying paintings, and within three or four years I had 30 or 40.”

Fast forward 30-something years. The general practitioner has just opened the Lakeshore Fine Art gallery, and hopes to deal in the likes of Warhol and Chagall.

And promote the idea of art as an investment.

Investing in art is not only more visible locally now with the opening of the Lakeshore gallery, it might be a wise move. Historically, collectible art has commanded a pretty penny. Best of all - it’s enjoyable.

In recent years, top-flight art is more than chic. It’s hot, culturally and financially.

“The top rungs of the contemporary art market have continued to buck the recession as paintings by Edvard Munch and Fernand Leger set auction records for both artists in New York,” reads the lead sentence of a London Telegraph article from last week called Art collectors defy US downturn at Sotheby’s.

A cubist Leger work called Woman in Blue sold for $39.2 million, beating the artist’s previous record of $22.4 million, while Much’s Girls On A Bridge fetched $30.8 million, besting the $11 million his best known work Scream sold for.

From sales in London to Dubai, high-end art is flying high.

A Monet and a Rodin also set new records at Christie’s auction in New York in the last couple of weeks.

David Rockefeller Sr. is worth $2.5 billion, largely from trusts and real estate, though as Wikipedia says: “Another major source of asset wealth is his formidable art collection, ranging from impressionist to postmodern.” His mother Abby, after all, helped establish the Museum of Modern Art in New York in 1929.

These days, some investment funds earn profit solely through art. While this allows average people to invest in landscapes and portraits, however, it takes away a major benefit the wildly rich enjoy when they buy Van Goghs: enjoying the art.

“No. 1, art is something that can be enjoyed,” Wahby said. “When was the last time somebody sat down in their armchair and looked at their stock certificate? It can’t be enjoyed.

“The other thing from an investment point of view is that art is portable. If I buy a house, it has to stay here, whereas I can take a painting to New York or Philadelphia or Paris or Tokyo.

“But the main reason it has become such a great investment is because of the emotionality attached to fine art. It’s addictive.”

Most artists can tell you, however, that 99 per cent of art doesn’t sell for much, if at all. And doesn’t appreciate in value.

Wahby, who has bought and sold perhaps 600 paintings in his life, says the trick is to buy only those artists who have a proven track record at auction. Problem is, of course, those artists generally cost too much for most people. Who has an extra $5 million sitting around to buy a cheap Picasso?

Still, the stratospheric examples abound.

For instance, Picasso’s Boy with a Pipe, which sold in 1930 for $30,000, went for $104 million at auction in 2004.

The Mei Moses Index, which tracks art purchases, shows in the last 50 years art investments have easily out-performed bonds and have roughly kept pace with the S&P 500.

Predicting art prices is, as economist William Baumol once said, a “floating crap game.” Plus, the Mei Moses Index doesn’t factor in such things as art sales commission, which can be as much as 20 per cent.

Furthermore, expensive art is not liquid - and can take months or more to sell.

Still, Wahby’s main point about buying art holds true: a painting can provide pleasure.

“Advice that should always be given to anybody considering collecting art is to always buy according to their own tastes,” said Brenda Francis Pelkey, director of the University of WIndsor’s School of Visual Art. “Don’t buy work according to market value.

“You’ll be a lot more satisfied with what you get if you buy something that you really like, and if it’s in some way either meaningful to you in terms of its subject matter or its esthetic qualities.”

As ancient cave paintings indicate, humans have created art for almost as long as we have existed. Expressing creativity is thus part of the human experience, and enlivens everything from posters and magazines to movies and architecture.

“Art connects you to something outside yourself,” said Francis Pelkey, a photographic artist herself. “Art can have an emotional effect on people. One of the things art does is inspire the imagination in a way that is outside of your everyday life.”

Art also creates a reflection of our time, Francis Pelkey said, a mirror of concepts and staples and zeitgeist.

A very small amount catches on so much, it accrued more value than pure gold 0 these days with a modern flair.

Jackson Pollock’s No. 5, 1948, sold privately by music magnate David Geffen in 2006, still holds the record for most expensive painting ever with a pricetag of $140 million.

The year 2006 represented a zenith of sky-high art purchases, though the trend still appears healthy.

Last week, 85-year-old Lucien Freud’s 1995 portrait Benefits Supervisor Sleeping - sometimes referred to as Big Sue - was sold at auction by Christie’s in New York City for $33.6 million, setting a world record for sale price of a painting by a living artist.

One day later through Sotheby’s, the painting Triptych, 1976 by the late Francis Bacon (1909-1992) fetched $86.3 million, setting the record for the most expensive work of contemporary art ever sold at auction.

Though the prices at Lakeshore Fine Art fall considerably below the upper echelons of art collecting, they still reflect some serious work.

On the wall now, a Chagall lithograph lists for $25,000, while a minimal portrait by French artist Andre Brasilier goes for $43,000.

Meanwhile, Wahby - who owned a gallery on Pellissier Street and then in Yorkville in the ‘80s - would gladly procure loftier works than those.

He has sold Warhol prints, Picasso etchings and ceramics, and once unloaded a painting for $98,500.

“Now my goal is to sell a $1-million painting,” he said.

“I have a great time,” said Wahby, who welcomes browsers. “The artists are all kooks. There’s a story behind every painting. I’ve had some wonderful experiences with art. It’s my passion.”

But the big question is, can the Windsor area - where art galleries tend to come and go with the speed of drying paint - actually support a high-end boutique?

“That’s a good question,” said Wahby, who will soon have a Lakeshore Fine Art Website. “If it sells here, wonderful. Because that’s my goal, to put great art in the area. But if it doesn’t, it will sell somewhere.”

Windsor GP showcases his passion for art

The Medical Post | August 5th, 2008 | Ron Stang

DR. ALLEN WAHBY got bitten by the art bug while interning at Montreal’s Royal Victoria hospital in the 1970s. In his spare time he would haunt the art galleries in and around nearby Sherbrooke Street.

DR. ALLEN WAHBY got bitten by the art bug while interning at Montreal’s Royal Victoria hospital in the 1970s. In his spare time he would haunt the art galleries in and around nearby Sherbrooke Street.

Those visits opened his eyes to the vibrancy of painted images - their colour, variety, individuality, the stories they told and, above all, their emotional resonance.

Dr. Wahby, a family doctor in Windsor, Ont., says artists’ uniqueness has helped create incredible visions.

“As I look at paintings and as I observe and learn more, and talk to knowledgeable people and to great art dealers and artists, it occurs to me that this part of life is really tapped into your soul,” he says.

He references Indian physician and author Dr. Deepak Chopra,”who says the nature of the universe is vibrational. Everything vibrates. So when you look at a great painting or listen to a great symphony, they’re vibrating at a certain rate… and that really touches you in here,” gesturing to his heart.

Dr. Wahby’s love of art led him to start purchasing it. But his “wonderful addictive passion” created a problem: He didn’t have enough room to display or store the works. “So I thought, ‘The only way I can do this more is to get into the business’ “ He soon found selling art “was just as much fun as buying.”

In the years since, Dr. Wahby has travelled the world, to museums, auction houses and private dealers.

This spring he opened Lakeshore Fine Art in suburban Tecumseh, near Windsor.

Dr. Wahby not only would like his clientele to appreciate art but to consider buying it for investment purposes. Pointing out the gallery window he says, “That house there will only sell there, in Windsor. But if I take the Chagall (a March Chagall painting on his gallery wall) to New York or Paris or Tokyo or Toronto, I can sell it anywhere in the world.”

His advice to a novice investor? “Buy a known quantity.” There are ways, however, to check the appreciation of paintings of lesser-known artists, such as consulting the Mei Moses Index or Heffel Art Auction House.

Dr. Wahby, 58, is now devoting three afternoons a week to his gallery.

He says collecting and selling art has provided a reprieve from the sometimes gruelling pace of medicine. “As a busy GP, you’re constantly expending yourself,” he says. After returning to his office following trips abroad, “I just had this renewed energy.”

David Heffel, co-owner of Canada’s largest art auction house, Heffel’s, said it’s not unusual for a professional in another field to convert his passion for art to opening a gallery. “My father was in the steel business and an art collector, and retired early and turned his hobby into his vocation.”